Mukka Proteins Stocks Latest News : A Promising IPO Listing Plagued by Volatility

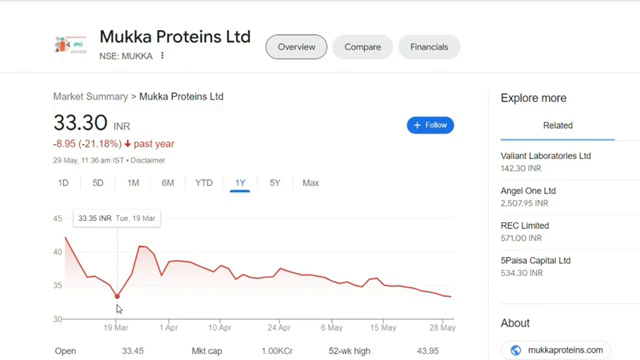

Mukka Proteins, a company operating in the fishmeal and fish oil industry, recently went public with an IPO that was well-subscribed. The company’s shares were expected to list around the ₹50 mark, but instead, they debuted at a much lower price of around ₹43-44. Since then, the stock has been on a downward trajectory, currently trading around the ₹33 level.

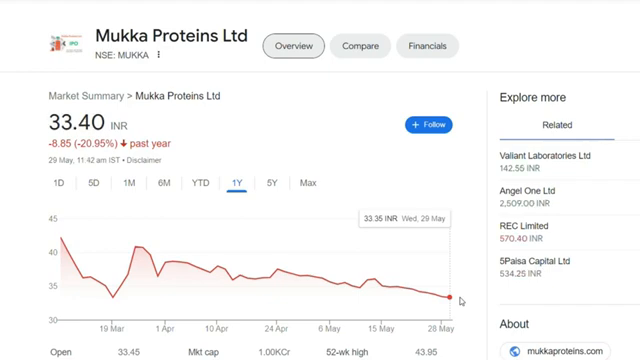

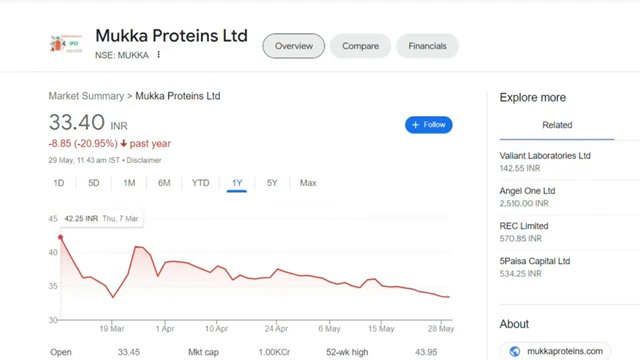

Analyzing the One-Month and One-Year Price Trends

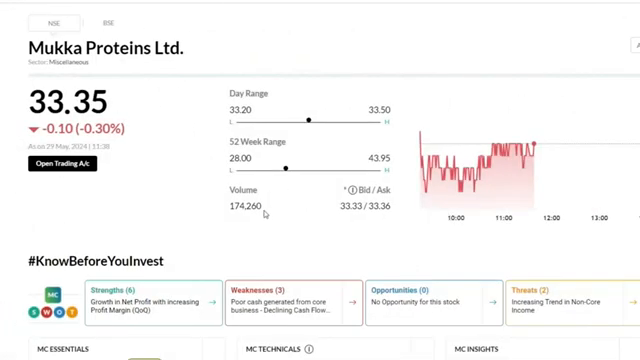

A closer look at Mukka Proteins’ price chart reveals a concerning trend. Over the past one month, the stock has been consistently declining, with only a few brief periods of upward movement. The lack of sustained buying interest and low trading volumes suggest that investors are not yet fully confident in the company’s prospects.

Examining the one-year price chart paints a similar picture. Despite being a relatively new listing, having gone public earlier this year, Mukka Proteins’ stock has failed to gain significant traction. The initial listing price of around ₹28 has not been reclaimed, and the stock continues to struggle to find a strong support level.

Factors Influencing Mukka Proteins’ Performance

Financial Performance

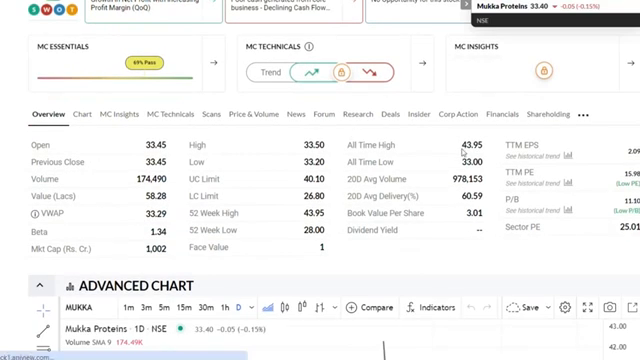

Mukka Proteins’ recent financial results have been a mixed bag. While the company has reported decent profitability, with a profit of ₹27 crore in the latest quarter, its revenue performance has been underwhelming. The company’s revenue declined from ₹420 crore in the previous year to just ₹260 crore in the latest quarter, indicating a significant drop in business activity.

The volatility in Mukka Proteins’ financial numbers is a cause for concern, as it suggests that the company’s operations may be subject to significant fluctuations. Investors will be closely watching the upcoming quarterly results to see if the company can stabilize its revenue and maintain its profitability.

Shareholder Composition and Institutional Interest

Mukka Proteins’ shareholder composition is also worth noting. The promoters hold a significant 73.3% stake in the company, indicating a high level of insider ownership. However, this also means that the stock’s trading liquidity may be limited, as the free float is relatively small.

Institutional investors, who often provide stability and long-term support to newly listed companies, have a modest presence in Mukka Proteins. Domestic institutions hold around 2% of the shares, while foreign institutional investors hold 6.46%. This relatively low institutional ownership could be contributing to the stock’s volatility and lack of buying support.

The Road Ahead: Cautious Optimism and Watchful Waiting

Given the current state of Mukka Proteins’ performance and the industry dynamics, investors should approach the stock with cautious optimism. The ₹33 level, which has acted as a support in the past, remains a crucial level to watch. If the stock is unable to hold this level, it could signal further downside and potentially test the IPO price of ₹28.

For now, it may be prudent for investors to adopt a “wait-and-watch” approach, closely monitoring the company’s upcoming quarterly results and any changes in the shareholder composition. The next few quarters will be crucial in determining whether Mukka Proteins can stabilize its operations, improve its financial performance, and regain investor confidence.

Conclusion

Mukka Proteins’ journey as a publicly traded company has been marked by volatility and a lack of sustained buying interest. While the company’s financial performance has shown some promise, the overall trend suggests that investors remain cautious. As the company navigates the challenges of the fishmeal industry, it will be crucial for Mukka Proteins to demonstrate consistent growth, stable financials, and the ability to attract stronger institutional support. Until then, a prudent approach of patient observation may be the best course of action for investors. Follow us for Mukka Proteins Stocks Latest News.

Call +91-7899393441 or Click here to join our Stock Market Course

Disclaimer : We are NOT a SEBI registered advisor or a financial adviser. Any of our investment or trades we share on our blogs are provided for educational purposes only and do not constitute specific financial, trading or investment advice. This blog is intended to provide educational information only and does not attempt to give you advice that relates to your specific circumstances. You should discuss your specific requirements and situation with a qualified financial adviser. We do share details and numbers available in the public domain for any company or on the websites of NSE and BSE.