Multibagger Stocks to buy now

When high-quality companies enter the market, they can often provide exceptional returns in their first few months or years of trading. Stocks like IRCTC, LIC Housing Finance, and MT AR Technologies have delivered 100% or more gains shortly after their IPOs. That’s why it’s important for investors to keep an eye on newly listed stocks which can be a source of significant outperformance. In this article we will show you some of the multibagger stocks to buy now that may give you good returns.

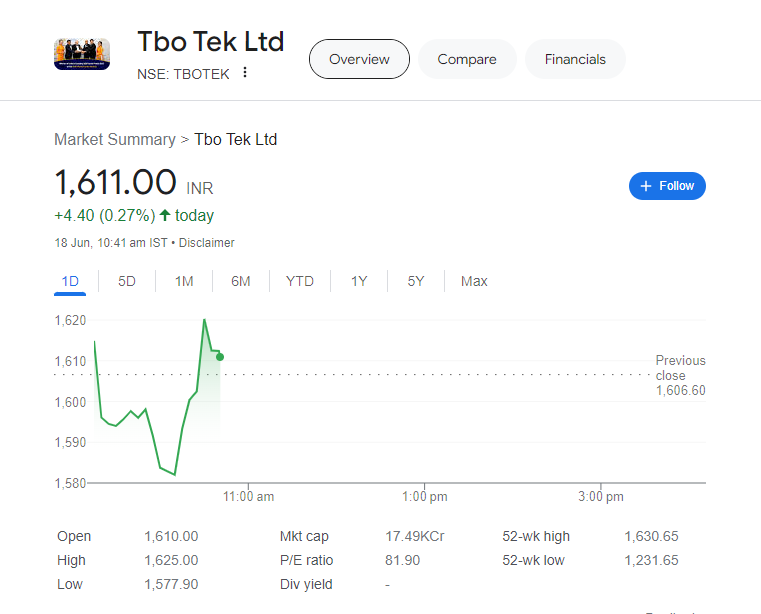

1) Tbo.com

One newly listed company that looks promising is Tbo.com. This online B2B travel distribution platform provides booking services for hotels, airlines, car rentals, transfers, cruises, insurance, and more. Tbo.com has a presence not just in India, but also in Africa, the Middle East, Europe, North America, and the Asia-Pacific region as it expands its business globally.

Tbo.com went public on May 15, 2022, listing at ₹55 per share and closing up 55% on its first day. The stock currently trades around ₹1,540 and has already delivered 23% returns in just 3 days after a 12% dip on June 4. With a market cap of ₹16,704 crore, Tbo.com has excellent profitability metrics, including a Return on Capital Employed (ROCE) and Return on Equity (ROE) both over 40%, which is considered very good. The company has negligible debt and a healthy ICRA score of 6.

While Tbo.com’s valuation is a bit high, with a P/E ratio around 80 (double the industry average), the stock could still be worth considering if you believe in the long-term growth of the online travel industry. The company has shown strong sales and profit growth, with Q4 revenues jumping 28% year-over-year. If Tbo.com can maintain this level of profit expansion, it could deliver impressive returns going forward. Additionally, the stock has strong institutional backing, with FIIs holding around 40% of shares. For those looking for multibagger stocks to buy now, Tbo.com might be an attractive option.

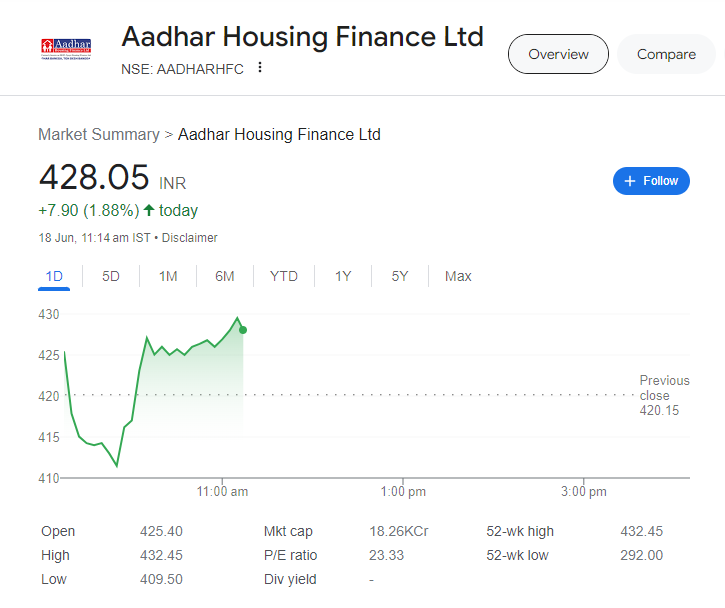

2) Aadhaar Housing Finance:

Another interesting new listing, and a potential multibagger stock to buy now, is Aadhaar Housing Finance, one of India’s largest low-income housing finance companies. With over 500 branches, primarily in Maharashtra and Uttar Pradesh, Aadhaar Housing has a strong regional presence.

The company’s profits have grown from ₹141 crore to ₹202 crore, and it has not seen a single year-over-year decline in net profits over the past 5 years—a sign of consistent performance. Aadhaar Housing Finance listed on May 15, 2022, at a 5% premium, and the stock currently trades around ₹387, providing 17% returns so far. While its valuation with a P/E of 22 is reasonable, and the debt-to-equity ratio of 3.14 is on the higher side for a finance company, the consistent profitability and growth of the affordable housing finance sector make this a stock worth considering.

3) JNK India Ltd:

Jenko India is another newly listed company that stands out. It manufactures process furnaces, reformers, and cracking furnaces used in the oil and gas, petrochemicals, fertilizers, and many other industries. Jenko was established in 2010 and had a strong IPO debut on April 13, 2022, listing at a 50% premium.

While the stock has seen some profit-booking since its listing, it has started to gain momentum in recent days. Jenko’s profits have grown from ₹11 crore to ₹17 crore on a year-over-year basis, and the company has maintained consistent profitability over the past 4 years. With a market cap of ₹3,502 crore, Jenko has a ROCE of 46% and ROE of 39%, which are excellent metrics. The valuation with a P/E of 55 is a bit on the higher side compared to its peers, but the company’s debt-free balance sheet and strong growth potential make it an interesting prospect for long-term investors. Given its impressive financial performance and growth trajectory, Jenko India is one of the multibagger stocks to buy now.

4) Exicom Tele-Systems Ltd :

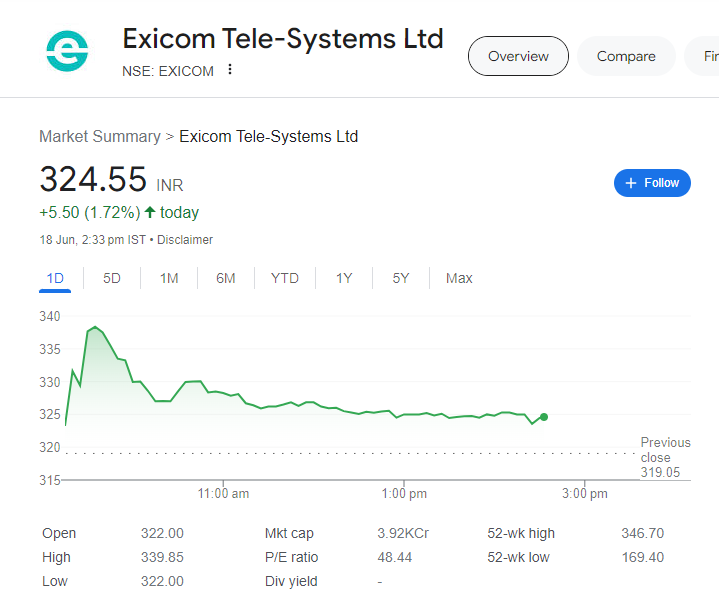

Exicom Tele-Systems Ltd is a company that stands out in the rapidly growing electric vehicle (EV) charging infrastructure space. As one of the largest players in India’s DC power systems, residential charging, and public charging segments, Exicom Tele-Systems Ltd is well-positioned to capitalize on the expected 66% growth in the Indian EV market by 2024.

The company currently has a 16% market share in the DC power systems market and 60% in the residential charging segment, along with a 25% share in public charging. Exicom Tele-Systems Ltd has already installed over 60,000 EV chargers across 400 locations in India, demonstrating its strong experience and execution capabilities in this space. In the last quarter, the company reported a massive 67% jump in profits to ₹66 crore, its highest ever.

While the stock has corrected 28% from its recent high, it is still available at a reasonable valuation, with a P/E of 48.37. If you believe in the long-term growth of the EV charging market, Exicom Tele-Systems Ltd could be an interesting pick, especially if the stock sees further corrections. The company has a strong promoter holding of 69.57%, along with significant institutional investments from entities like IIFL and DSP. With its robust market position and growth potential, Exicom Tele-Systems Ltd is one of the multibagger stocks to buy now.

5) Krystal Integrated Services:

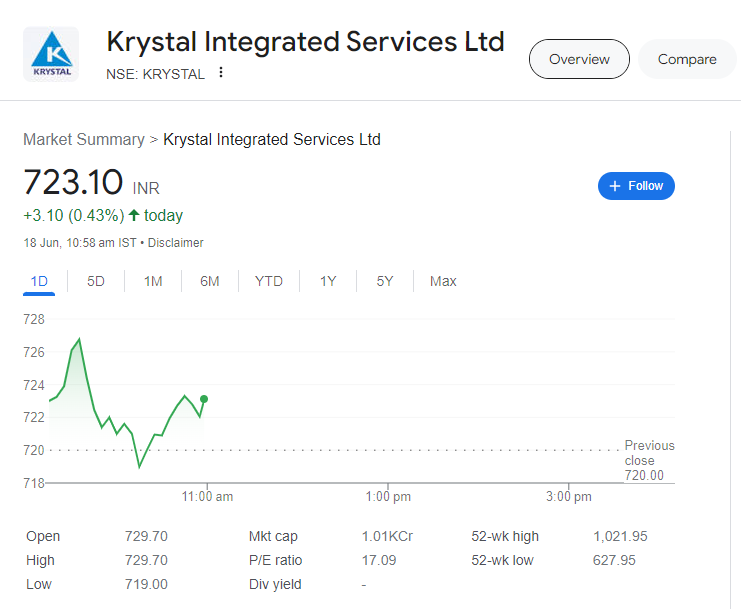

The last stock on our list of multibagger stocks to buy now is Krystal Integrated Services, one of the largest players in the integrated facility management and housekeeping services space in India. Krystal provides a wide range of services including facility management, landscaping, mechanical, electrical, and plumbing, among others, to large clients like hospitals, railway stations, schools, and airports.

Krystal Integrated Services had a decent IPO on March 21, 2022, listing at a 10% premium. In just 20 days after listing, the stock surged 42% to hit a high of ₹1,021 before correcting 28% from those levels. Currently trading around ₹728, the stock looks attractively valued at a P/E of 21.

Krystal has shown strong revenue and profit growth, with profits jumping 67% year-over-year to ₹15 crore in the latest quarter. The company has a healthy ROCE of 20% and ROE of 25%, while maintaining a debt-free balance sheet. With a strong promoter holding of 70% and significant institutional investments from entities like IIFL and DSP, Krystal Integrated Services could be an interesting pick for investors seeking exposure to the growing facility management space. This multibagger stock is worth considering for your portfolio.

Conclusion

The stocks discussed in this article represent a mix of newly listed companies across different sectors – travel, housing finance, industrial equipment, EV charging, and facility management. While each has its own unique business model and growth prospects, they all share the common trait of being relatively new market entrants with the potential to deliver outsized returns for investors.

As always, thorough research and a long-term investment horizon are crucial when considering these types of stocks. But for those willing to put in the work, newly listed companies can be a rich hunting ground for finding the next crop of multibagger stocks to buy now.

Call +91-7899393441 or Click here to join our Stock Market Course

Disclaimer : We are NOT a SEBI registered advisor or a financial adviser. Any of our investment or trades we share on our blogs are provided for educational purposes only and do not constitute specific financial, trading or investment advice. This blog is intended to provide educational information only and does not attempt to give you advice that relates to your specific circumstances. You should discuss your specific requirements and situation with a qualified financial adviser. We do share details and numbers available in the public domain for any company or on the websites of NSE and BSE.